Small business owners know that time is precious. There are never enough hours in the day, and you need all your energy, insight, and diplomacy to keep everything humming along. It’s difficult to dwell on the “what ifs” when you’re juggling a host of absolutes.

But unforeseen disasters happen – and more frequently than you might imagine. Big problems can grow from sudden events that interrupt operations or prevent talented employees from doing their work, especially when you don’t know how to respond. Whether it’s a data breach or a hurricane, a fire or a virus outbreak, a good business continuity plan can help your small business clear big hurdles.

What is business continuity – and why is it so important?

Your worst business fear has come true: an emergency just sidelined your operations. While you tend to the immediate fallout of the flood, fire, pandemic, or other critical event, you’ll also have to deal with logistical challenges like ensuring employees can continue to work, maintaining your supply of materials, and keeping up the demand for your services.

If this scenario makes your heart race, you’re not alone. This is where business continuity comes in: it’s about anticipating the financial and operational consequences of a disruption, and planning ahead to help your business return to normal operations as quickly as possible.

A number of important elements go into business continuity planning, including a review of your main risks, managing the risks with good back-up plans, business insurance, and the recovery and continuity plans themselves. But before you can sort out the details, you’ll need to understand where your business stands – and where your vulnerabilities lie.

How to create a business continuity strategy

In order to develop an appropriate business continuity plan, you’ll need to know the risks you’re facing. You may not be able to prepare for each and every risk that’s out there, but acknowledging the major threats to your operations will help you position your business for a quicker recovery.

In order to develop an appropriate business continuity plan, you’ll need to know the risks you’re facing. You may not be able to prepare for each and every risk that’s out there, but acknowledging the major threats to your operations will help you position your business for a quicker recovery.

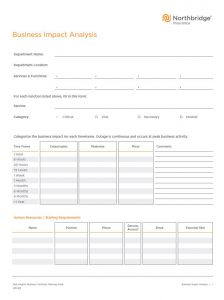

Business impact analysis

No matter the size of your company, business impact analysis can help you predict how an interruption to your core operations would affect your business. The process begins with identifying your critical services, products, and operations, and then ranking them by priority to paint a picture of what elements might call for more attention.

Download our Business Impact Analysis form to get started!

The likelihood of specific emergencies also comes into play, and the biggest threats to your business often depend on your industry and location (for instance, if you’re near a river, flooding could be a top threat). However, some risks are universal among small businesses, like pandemics or cyber risk. In turn, any modern business continuity strategy should consider how best to handle a wide-spread virus and how to recover and rebound from the phishing scams, malware, and countless other cyber threats lurking around your connected devices.

What’s in a plan?

There are different sorts of plans to deal with different aspects of an emergency. The following three plans are distinct, but they can work together to help your business recover from a crisis:

An incident response plan is used during the incident to manage and contain the damage that comes from the emergency, whether it’s a natural disaster, security breach, or cyber attack. The goal of this type of plan is to limit damage and the associated costs that immediately follow the event – it’s an important short-term response.

A disaster recovery plan comes into play after you’ve mobilized your initial response. It will help you put measures in place that can continue to limit damage, and like your incident response plan, your disaster recovery plan should clearly define the tasks of key players to help get systems up and running.

Where cyber risk is involved, disaster recovery plans are typically data-centric: they can involve restoring IT infrastructure (no matter how small your network may be) and accessing copies of data stored offsite. Natural disasters like flood, wildfire, earthquake, or hurricane can call for other measures, like access to a power generator and a direct line to equipment specialists and vendors.

The business continuity plan is broader than a disaster recovery plan, often including elements of the other plans. It can be described as business-centric, as it’s generally more concerned with things like finding a safe place for employees to work, and conducting damage control with public relations efforts. It also aims to ensure network connections, equipment, and crucial business applications can continue to run without downtime.

3 tips to help craft a great small business continuity plan

There’s a lot to consider including in your plans, no matter how big or small your business may be. Disaster recovery and business continuity templates can offer good guidance, helping you organize your strategy and even consider elements you may not have thought about.

However, every plan can and should be customized to better support your company. Here are a few tips to help you build a business continuity plan to suit your business:

1. Brainstorm potential problems

Thinking about all the ways things can go wrong can be a stressful exercise, but if you sit down as a team to discuss the obvious (and less obvious) risks to your business now, you’ll be able to build a plan that responds well to a crisis.

You can begin by asking yourselves a few questions, like:

Is your building vulnerable to extreme weather or natural disaster? If so, you might consider a secondary or remote location that could host your team and operations when you’re forced to evacuate your premises. There may also be ways to improve your current warning or alarm systems to help you react swiftly.

Are your records up to date? Having a complete list of important contacts like vendors, service providers, emergency personnel, and equipment specialists can save a lot of time and effort when you’re scrambling to prevent further damage or loss. In contrast, an outdated list of contacts could set back your recovery efforts for hours, if not days.

How do you handle your data? As cybercrime advances, it’s more important than ever to frequently back up your important files on a shared drive or external drive. Cloud-based servers can help you recover digital data safely and quickly. If you don’t have an IT department to keep on top of security measures, it’s particularly important to train employees to spot and mitigate cyber risk.

Are you vulnerable to theft or other crime? If you work with expensive materials or goods, very sensitive information, or anything that would be particularly enticing to thieves, your staff will need to know what to do in case of a break-in or confrontation. This may also be the time to upgrade your surveillance efforts.

This list is merely a jumping-off point – there are plenty of aspects that could affect your risks, which is why it’s a good idea to put your heads together and consider all angles.

2. Divide and conquer

Everyone should have – and know – their role to play in the recovery effort. Emergencies can be chaotic situations, and without a clear division of duties your workspace could descend into confusion. Here are some ideas to consider:

- If you don’t have a public relations team, designate someone to lead damage control efforts (if you’ve prepared a statement ahead of time, it will makes things easier).

- Make sure some employees have basic first aid training so they can offer immediate assistance until professional help arrives.

- Train multiple people on important roles and functions, so operations don’t come to a standstill if a crucial employee is absent.

- Don’t be the only one who knows where important documents are kept – confide in a colleague so they can access emergency contact numbers or insurance documents in case you’re away.

A contingency plan will help your business stay open with remote data access, offsite schedules, and prepared statements to explain the status of your operations. You might consider grouping employees into contingency teams to better organize the effort.

3. Practice makes perfect

It’s not enough to have a recovery plan in place; you’ll need to test and adapt it regularly. Once you’ve clearly communicated (and recorded) your set of procedures in case of fire, cyber breach, theft, or other disaster, it’s a good idea to conduct a mock-run.

Drills, hypothetical tests, and ongoing staff training can all play a part in testing how well the plan functions. Have you found a weak point? Make a change! The most important aspect of a business continuity plan is that it works for your business. You should test and review your plan often. The more you test the plan, the more you can refine it, the more comfortable your team will be, and the better you’ll be able to respond in an emergency.

Consider calling in an expert

Remember that there’s a lot riding on your business continuity plan – including your reputation. Word travels fast in the digital world, and that means you’ll need to react and reassure your customers and partners as quickly as possible if an incident sets your business back. If you can communicate honestly and effectively while you put your continuity plan into action, you stand a better chance at retaining customers and keeping your edge over the competition.

Depending on the size and nature of your business, you may want to lean on experts to help you develop an appropriate response, recovery, and continuity plan. There are many points to consider, and it’s better to be safe than sorry; a risk management specialist can help you assess your risk, and fine-tune your risk management strategy with careful monitoring and training solutions. To learn more, visit our Risk Services page today!