How a loss prevention program can help your business

Preventing a loss may seem like common sense, but there’s more to it than you might imagine. When it comes to having a strong loss

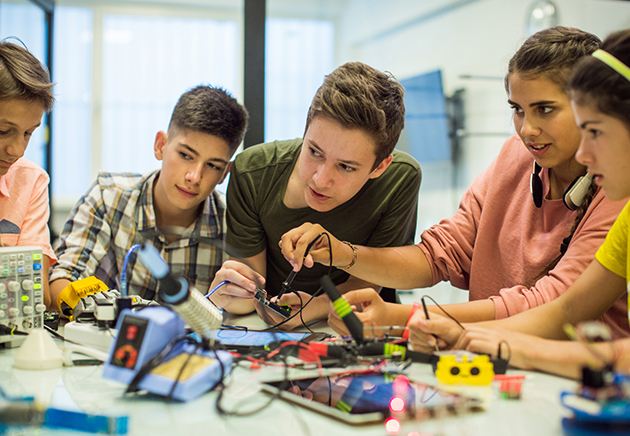

Running a childcare service, school, or camp takes care and commitment – and a whole lot of support. The appropriate insurance can help cover you when problems pop up on and off your property.

Find out how the right coverage can help protect your buildings and property, as well as any general liability concerns arising from injuries onsite or during offsite outings.

The education and childcare sector faces risks at every level – to buildings, people, and operations. From primary schools to universities to summer camps, all institutions need appropriate insurance to help ensure everything stays on track if an emergency arises.

Risks to educational institutions, daycares, and camps are often liability-related: many claims result from slips, trips, and falls. Incidents happen more often in poorly maintained and frequently used areas – think walkways, parking lots, and stairwells.

We tailor our insurance to the most prevalent risks in your industry – and to some you may not have considered.

Jungle gyms, playrooms, concrete yards, bulky furniture…there are plenty of things that can get in the way and cause injury. Hazards can grow when snow, water, ice, or general debris is added to the mix. What would happen if someone was injured on your property and decided to sue? That depends on the coverage you have in place.

Whether or not you’re truly at fault, a lawsuit could result in substantial legal fees for you. Fortunately, your commercial general liability coverage can support you in these sorts of situations: it’s designed to help cover your business if a child, visitor, or any other third party suffers bodily injury or property damage wherever your business operates.

Water damage can be traced to a number of sources, from a leaky roof to a backed-up toilet, and kitchen fires can start from a single greasy pan. Educational facilities, daycares, and camps can be chaotic by nature, and with so much to supervise, these sorts of incidents could go unnoticed until after the damage is done.

It’s important to take steps to prevent flooding and fire damage, but you need commercial property insurance to help cover property damage or loss (whatever facilities you might have on the premises). Commercial property can help shoulder the costs to repair or replace equipment, accessories and incidentals, or even the building itself. Of course, each facility has different coverage needs, which is where your broker’s guidance can come in handy.

Do you bus students between buildings, on field trips, or to and from other offsite events? Waivers are crucial to cover your liability risk, but how about protection for your vehicles?

If you rely on your own or your staff’s vehicles to shuttle people around, make sure you’re not relying on your personal auto insurance: commercial auto insurance can go a lot farther, with coverage for injuries to drivers and passengers, costs for a replacement vehicle, and even lost wages that result from a covered accident.

When working in the educational, daycare, and camp sectors, you don’t want to take any chances. That’s why it’s important to have additional coverages tailored to your unique business needs.

Our underwriting team understands the exposures in the education sector, so we can adapt and expand our offerings as our customers’ needs grow.

On top of our comprehensive core coverage and exceptional customer service, your business insurance policy grants you access to our Assist services* for extra peace of mind.

Unparalleled industry expertise, professional guidance, and innovative approaches to managing risk help our Northbridge Risk Services experts stay one step ahead of the crowd. Each year, our team conducts over 5,000 risk assessments and service calls for businesses across Canada. Our on-site assessments are complemented by a selection of in-depth training programs and educational tools to help companies excel in their industries.

Our Risk Services team offers technical publications to help you gain a better understanding of the potential exposures in your industry, and they can provide personal guidance to help fine-tune your daily operations. Find out more about what our experts can do for your business here.

Preventing a loss may seem like common sense, but there’s more to it than you might imagine. When it comes to having a strong loss

Before you buy, lease, or rent a new commercial space, water damage is the last thing any business owner wants to deal with. Checking your

The effects of flooding can be greatly reduced by taking preventative and precautionary measures. We’ve put together a comprehensive list of things you can do

* Legal Assist not provided for criminal, personal or insurance issues, do not provide representation in legal proceedings or legal fees coverage, and provided by Assistenza International, through lawyers licensed in your jurisdiction. Risk Management Assist provided by our Risk Services specialists and are intended to augment your internal safety, compliance and risk management practices, and are not a substitute for professional or legal advice. Trauma Assist provided by independent third-party professionals, long-term and specialized counseling not included. Cyber Assist is provided by an independent third-party service provider. Services are not included in any cyber extension or endorsements. Services are not an insurance policy, not all policies are eligible, contact us for details.