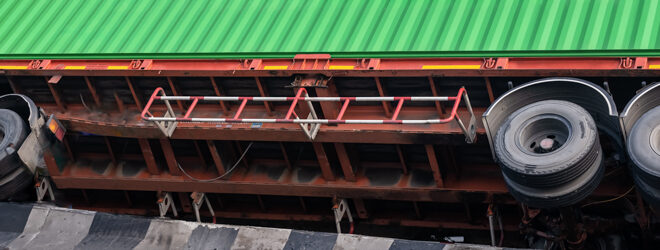

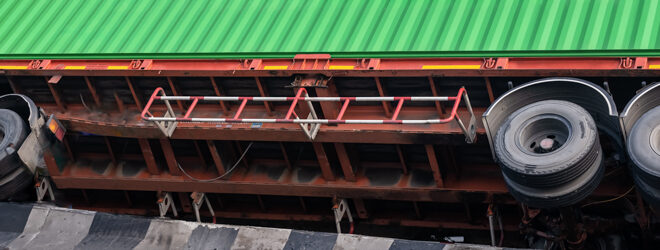

Collision report for commercial drivers and truckers

You’re a safe driver, but you can’t control road conditions or how other vehicles behave while driving. Every carrier and transportation company is responsible for

Insurance can be complicated, but it’s important – too important to ignore. For many people, this can mean stress, confusion, and headache as they try to compare insurance policies and choose the right coverage. If the time comes to file a claim, the worry can flood back in: what if you don’t have the support you need to recover from your loss?

A business insurance broker wears many hats – they can use their knowledge, experience, and insight to guide you through the entire insurance process.

A broker acts on behalf of you, their client. They will take the time to understand your background, your current needs, and your expectations to help you identify the risks your business faces every day. Once you’ve narrowed down the risks, your broker will help you better manage those hazards, determine the appropriate type and extent of coverage you need, and find the best business insurance solution for you.

Insurance brokers have a fairly broad scope of expertise, from advising on general risk management to navigating specific insurance offerings. What’s more, they can communicate this technical information clearly and concisely to their clients.

Not all business insurance brokers are the same: some specialize in one particular type of insurance, while others deal with a variety of sectors and products, and they could either work independently or for a brokerage.

All you need to stay protected is an insurance policy from a reputable insurer…right? Not so fast. Working directly with an insurance company is one option, but here are four good reasons to add an insurance broker to the mix.

Insurance brokers not only provide a human touch, they offer a wealth of support at each step of the way. In the end, a direct line to a proactive broker who knows your industry could improve your entire insurance experience.

If you’re shopping for insurance to suit a unique small business or specialized industry, you’ll probably benefit from some professional guidance. Insurance comparison sites won’t help you navigate the finer points of every insurance policy, but an insurance broker can help weigh the available coverage solutions and bundle your policies in a straightforward and cost-effective way.

Deciding to work with an insurance broker is the first step; now you need to find one that’s right for you. If you’re looking for an expert with a strong reputation and a good amount of experience with business insurance products, look no further than our network of preferred brokers.

Northbridge Insurance has partnered with hundreds of reputable Canadian brokers to make the insurance process easier and more fruitful for all of our customers. We know that a good broker relationship depends on comfort and communication, so we’ve made it easy to find a broker who will work well for you and your business.

You’re a safe driver, but you can’t control road conditions or how other vehicles behave while driving. Every carrier and transportation company is responsible for

Automatic Teller Machines (most commonly known as ATMs) are becoming big target items for thieves. Not only are they looking to steal money from the

The world of manufacturing is constantly evolving and changing , and 3D printers may be the next big step. For years, when the technology was